Facing an IRS dispute can be daunting, but you don’t have to go through it alone. At 7B Bookkeeping & Tax LLC, we understand the stress and complexity of these situations.

Professional IRS representation can make a significant difference in resolving tax issues efficiently and favorably. This guide will walk you through the process of navigating IRS disputes with expert assistance, helping you understand your options and take confident steps towards resolution.

Why IRS Disputes Occur

Common Triggers for IRS Disputes

IRS disputes happen more frequently than many people realize. In fiscal year 2023, the IRS closed 582,944 tax return audits, resulting in $31.9 billion in recommended additional tax. These disputes often stem from discrepancies between taxpayer reports and IRS records.

One of the most common triggers for IRS disputes is mismatched information. This occurs when the income you report doesn’t align with what the IRS receives from employers, banks, or other financial institutions. For example, if you omit income from a side gig or investment (even unintentionally), it can raise red flags.

Another frequent cause of IRS disputes involves claiming excessive deductions. The IRS uses statistical data to identify when deductions fall outside the norm for your income bracket. If you claim $50,000 in charitable donations on a $60,000 salary, it’s likely to attract attention. Keep in mind that you need to keep receipts for all donations, and if your non-cash contributions exceed $500, you must file IRS Form 8283 for detailed reporting.

Types of IRS Audits

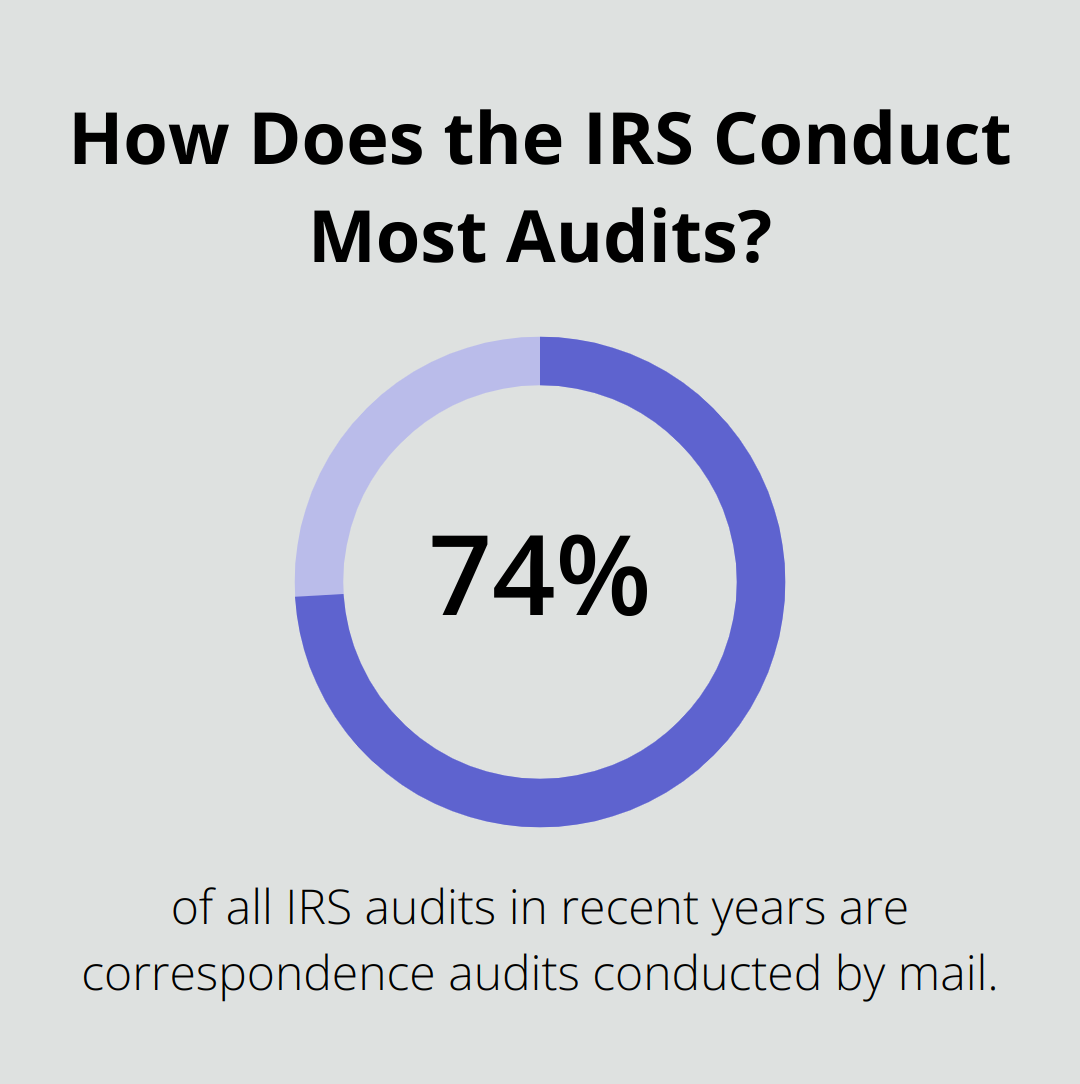

The IRS conducts several types of audits, each with varying levels of scrutiny:

- Correspondence Audits: These make up about 74% of all audits in recent years. The IRS conducts these audits by mail, typically focusing on specific issues.

- Field Audits: Less common but more comprehensive, these involve an IRS agent visiting your home or business.

- Office Audits: These fall between correspondence and field audits. You bring your records to an IRS office for review.

Consequences of Unresolved Disputes

Ignoring an IRS dispute can lead to severe repercussions. The IRS can impose penalties that compound over time, transforming a small tax bill into a significant financial burden. In extreme cases, the IRS may place liens on your property or levy your bank accounts.

Moreover, unresolved disputes can damage your credit score, making it difficult to secure loans or mortgages in the future. The emotional toll of living with unresolved tax issues shouldn’t be underestimated either.

The Value of Professional Assistance

Given the complexity of tax laws and the potential consequences of mishandling IRS disputes, many taxpayers find professional assistance invaluable. Tax professionals (such as those at 7B Bookkeeping & Tax LLC) possess the expertise to navigate these complex situations, often achieving more favorable outcomes than individuals might on their own.

As we move forward, we’ll explore the specific benefits of professional representation in IRS disputes and how it can make a significant difference in resolving your tax issues efficiently and favorably.

Why Professional Help Matters in IRS Disputes

Expertise in Complex Tax Laws

Tax laws present a labyrinth of complexity and constant change. The IRS Data Book for FY 2022 comprises 33 tables describing the full variety of IRS activities from returns processed, revenue collected and refunds issued. Tax professionals dedicate their careers to understanding and applying these laws, ensuring that your case receives the most up-to-date knowledge.

Effective Communication with the IRS

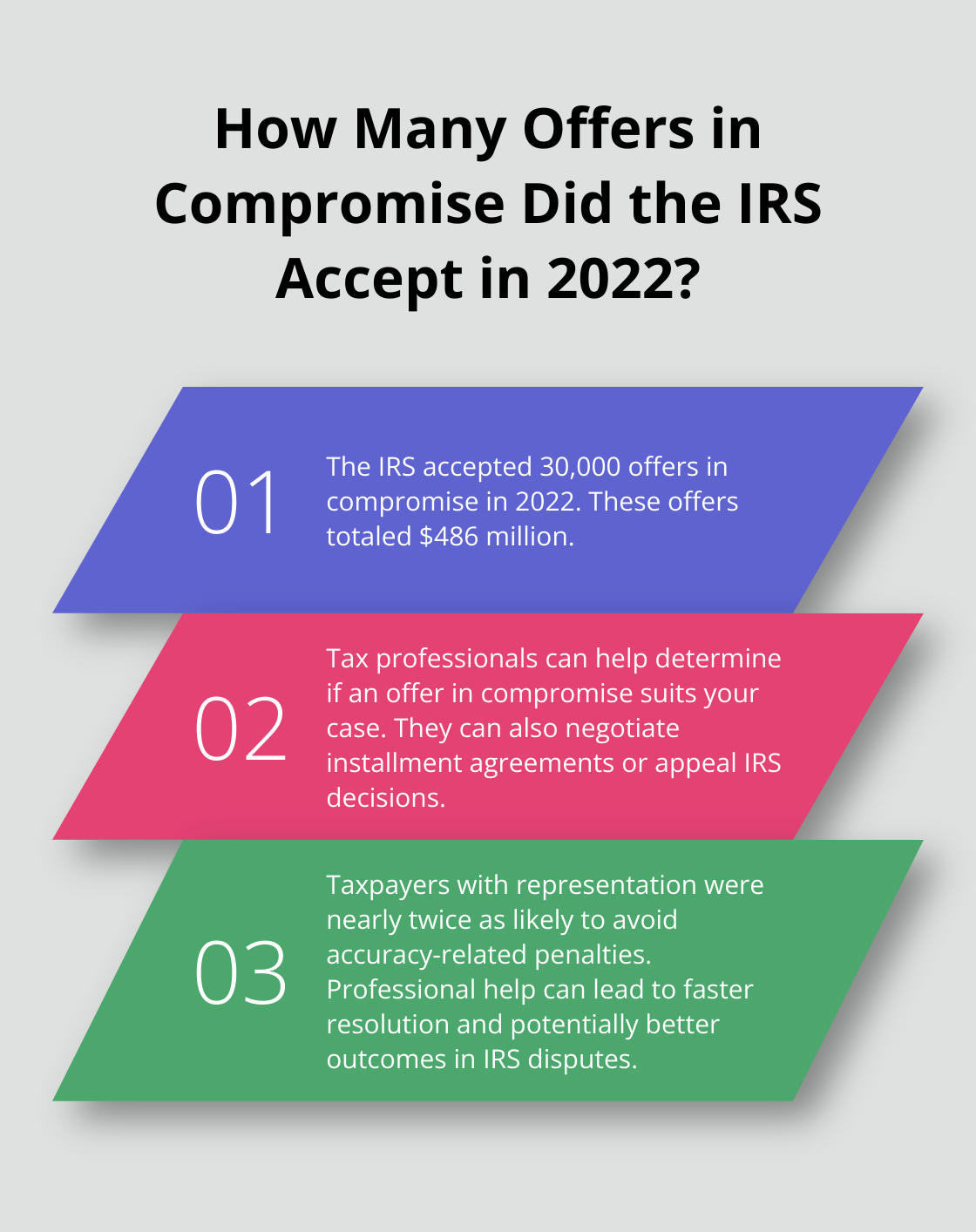

Tax professionals speak the language of the IRS. They interpret IRS notices, respond effectively, and communicate your case in a way that resonates with IRS agents. This can lead to faster resolution and potentially better outcomes. A study by the National Taxpayer Advocate found that taxpayers with representation were nearly twice as likely to avoid accuracy-related penalties compared to those without representation.

Strategic Approach to Resolution

Every IRS dispute requires a unique approach. Tax professionals assess your specific situation and develop a tailored strategy. They might negotiate an installment agreement, submit an offer in compromise, or appeal an IRS decision. In 2022, the IRS accepted 30,000 offers in compromise (totaling $486 million). A professional can help determine if this or another option suits your case best.

Stress Reduction and Time Savings

Dealing with the IRS consumes time and induces stress. A tax professional removes this burden from your shoulders, allowing you to focus on your daily life or business operations. They handle the paperwork, meet deadlines, and manage communications, saving you countless hours and reducing anxiety.

Qualifications That Matter

When choosing a tax professional, specific qualifications stand out. Enrolled Agents (EAs) receive licenses from the IRS and can represent taxpayers in all matters. Certified Public Accountants (CPAs) and tax attorneys also possess extensive training in tax law.

Cost-Effective in the Long Run

Hiring a professional incurs a cost, but it often proves a wise investment. Tax professionals help you avoid costly mistakes, identify overlooked deductions, and potentially reduce penalties. The money saved through their expertise often outweighs their fees.

Professional help provides more than just a response to the IRS; it offers a strategic approach to achieve the best possible resolution for your tax situation. The next section will outline the specific steps involved in resolving IRS disputes with professional assistance.

How to Resolve IRS Disputes Step by Step

Initial Assessment and Strategy Development

The resolution process starts with a comprehensive evaluation of your tax situation. A tax professional will review your financial records, IRS notices, and previous correspondence. This step is essential for understanding the full scope of the dispute and identifying potential resolution paths.

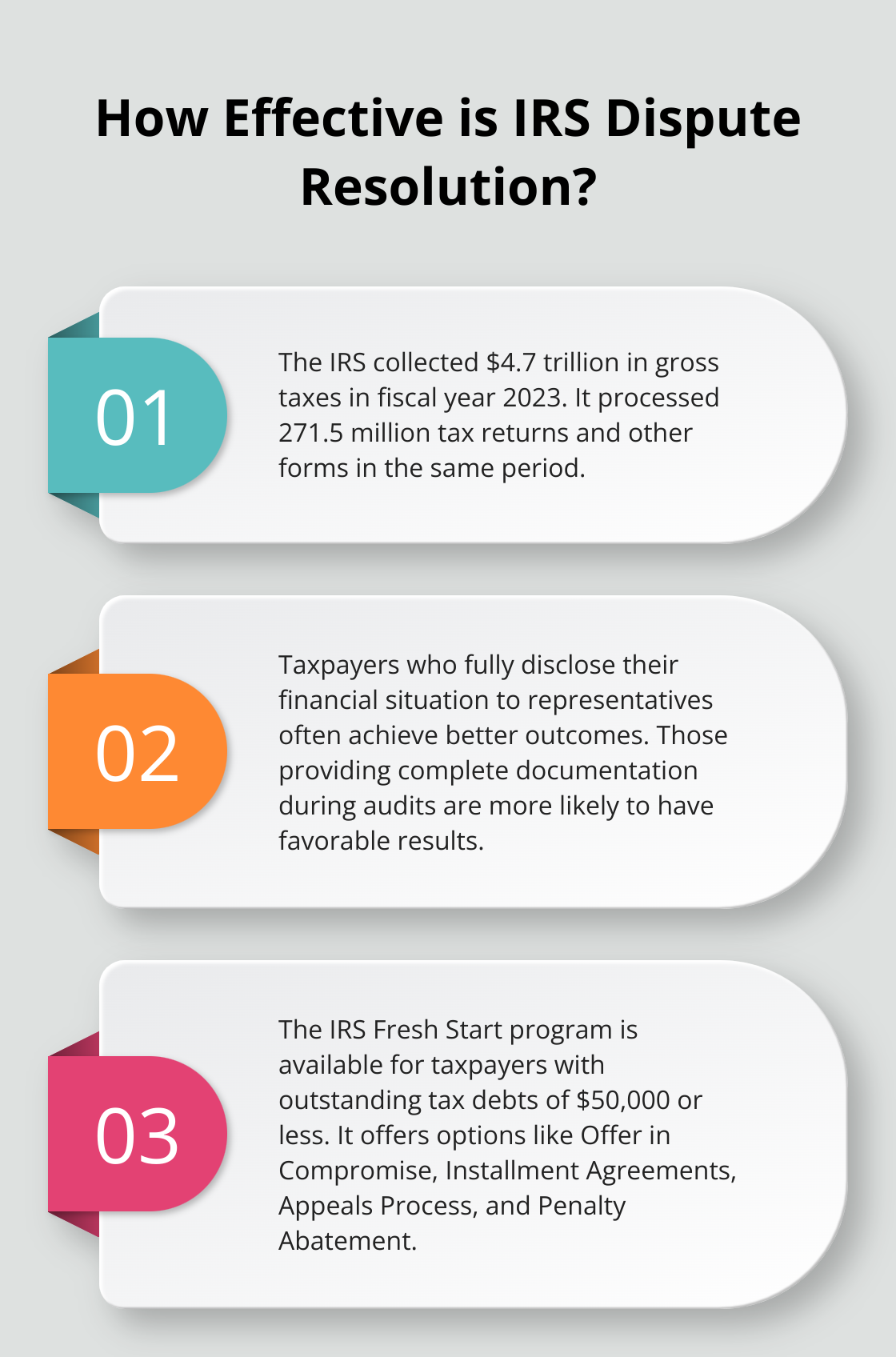

During this phase, your tax representative will ask detailed questions about your income sources, deductions, and any life changes that might have affected your tax situation. You should prepare to provide a complete picture of your finances. The Taxpayer Advocate Service reports that taxpayers who fully disclose their financial situation to their representatives often achieve better outcomes in IRS disputes.

Comprehensive Documentation Gathering

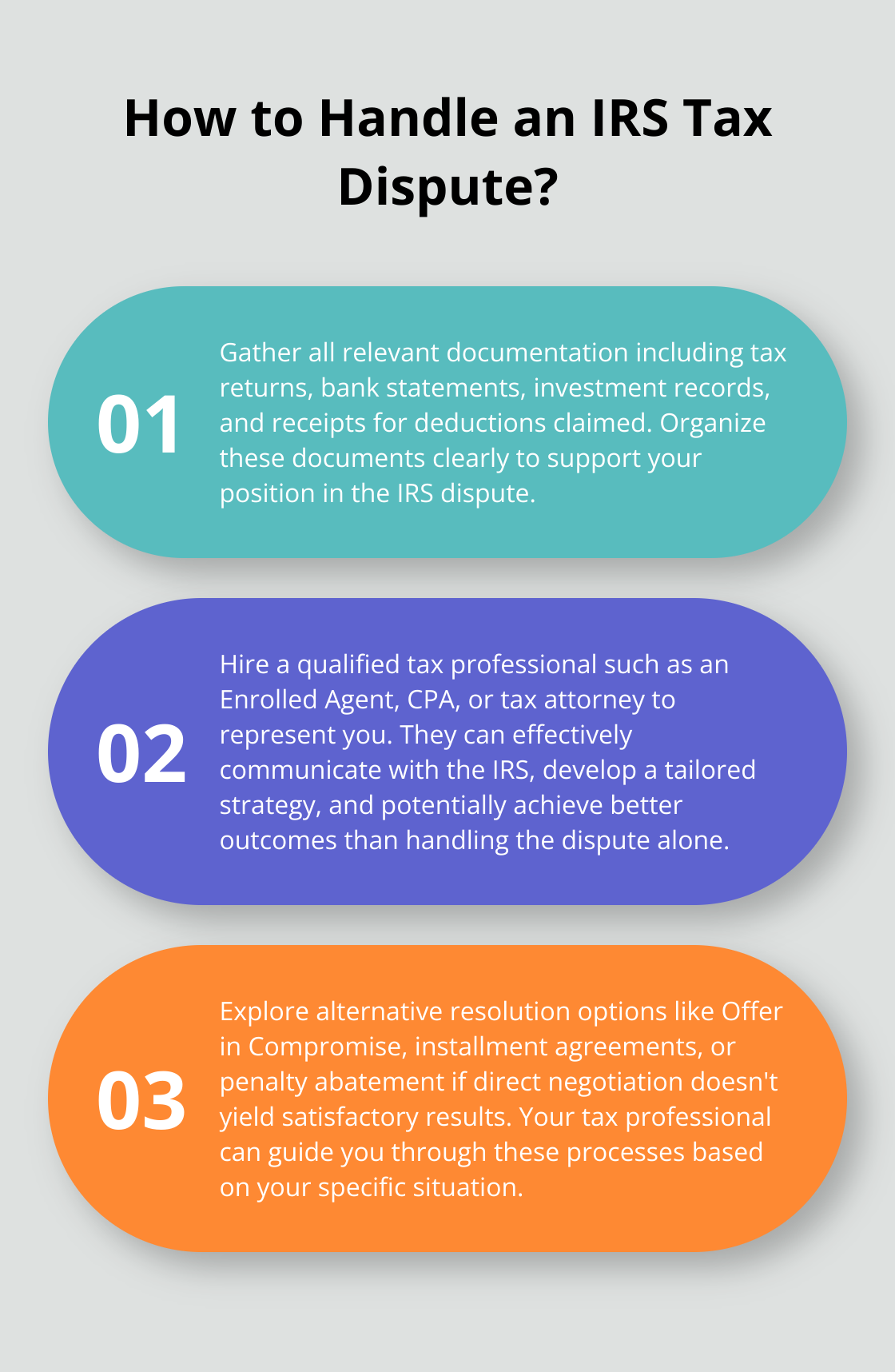

After the initial assessment, the focus shifts to gathering all necessary documentation. This step is paramount in its importance. The IRS operates on a system of documentation, and your ability to substantiate your claims can determine the outcome of your case.

Your tax professional will guide you in collecting relevant documents, which may include:

- Tax returns from previous years

- Bank statements

- Investment records

- Receipts for deductions claimed

- Employment records

- Any correspondence with the IRS

A Government Accountability Office study found that taxpayers who provided complete documentation during audits were more likely to have favorable outcomes. Your tax professional will help organize these documents in a manner that clearly supports your position.

Negotiation and Communication with the IRS

With a solid understanding of your case and comprehensive documentation in hand, your tax professional will initiate communication with the IRS. This often involves submitting a formal response to the IRS notice, explaining your position, and providing supporting evidence.

The negotiation phase can be complex and may involve multiple rounds of communication. Your representative will use their expertise in tax law and IRS procedures to advocate on your behalf. They may propose alternative interpretations of tax law that support your position or negotiate payment plans if you owe back taxes.

In fiscal year 2023, the IRS collected nearly $4.7 trillion in gross taxes and processed almost 271.5 million tax returns and other forms. These figures underscore the importance of accurate representation and negotiation in tax matters.

Exploring Alternative Resolution Options

If direct negotiation doesn’t yield a satisfactory result, your tax professional may explore alternative resolution options. These might include:

- Offer in Compromise: This allows you to settle your tax debt for less than the full amount owed if paying the full amount would cause financial hardship.

- Installment Agreements: These allow you to pay your tax debt over time through monthly payments.

- Appeals Process: If you disagree with an IRS decision, your representative can guide you through the appeals process.

- Penalty Abatement: In some cases, it’s possible to have penalties reduced or removed if you can demonstrate reasonable cause for your tax issue.

The IRS Fresh Start program is available to taxpayers with outstanding tax debts of $50,000 or less and those who can demonstrate financial hardship. Your tax professional will assess which options are most suitable for your specific situation.

Throughout this process, clear communication between you and your tax professional is paramount. Regular updates and prompt responses to any requests for additional information will help keep your case moving forward efficiently.

Final Thoughts

IRS disputes require prompt action and expert guidance. Professional IRS representation offers numerous advantages, including in-depth knowledge of tax laws and effective negotiation skills. Tax experts interpret complex IRS notices, develop tailored strategies, and advocate on your behalf for the best possible outcome.

7B Bookkeeping & Tax LLC provides comprehensive IRS representation services. Our team includes a Chartered Tax Professional and Enrolled Agent who can guide you through the dispute resolution process. We offer secure, remote tax preparation and reliable representation before the IRS to protect your rights and present your case favorably.

Our expertise extends beyond dispute resolution to include flat-rate bookkeeping services. We manage account reconciliation and payroll via QuickBooks Online (a popular accounting software). Don’t let tax issues linger – take action today and secure expert guidance to move forward with confidence.