Remote bookkeeping is transforming how small businesses manage their finances. At 7B Bookkeeping & Tax LLC, we’ve seen a surge in demand for these services.

Technology has made it possible for businesses to access expert financial support from anywhere. This shift is reshaping the landscape of small business accounting, offering new opportunities for efficiency and growth.

What’s Driving the Remote Bookkeeping Revolution?

The Digital Transformation of Financial Management

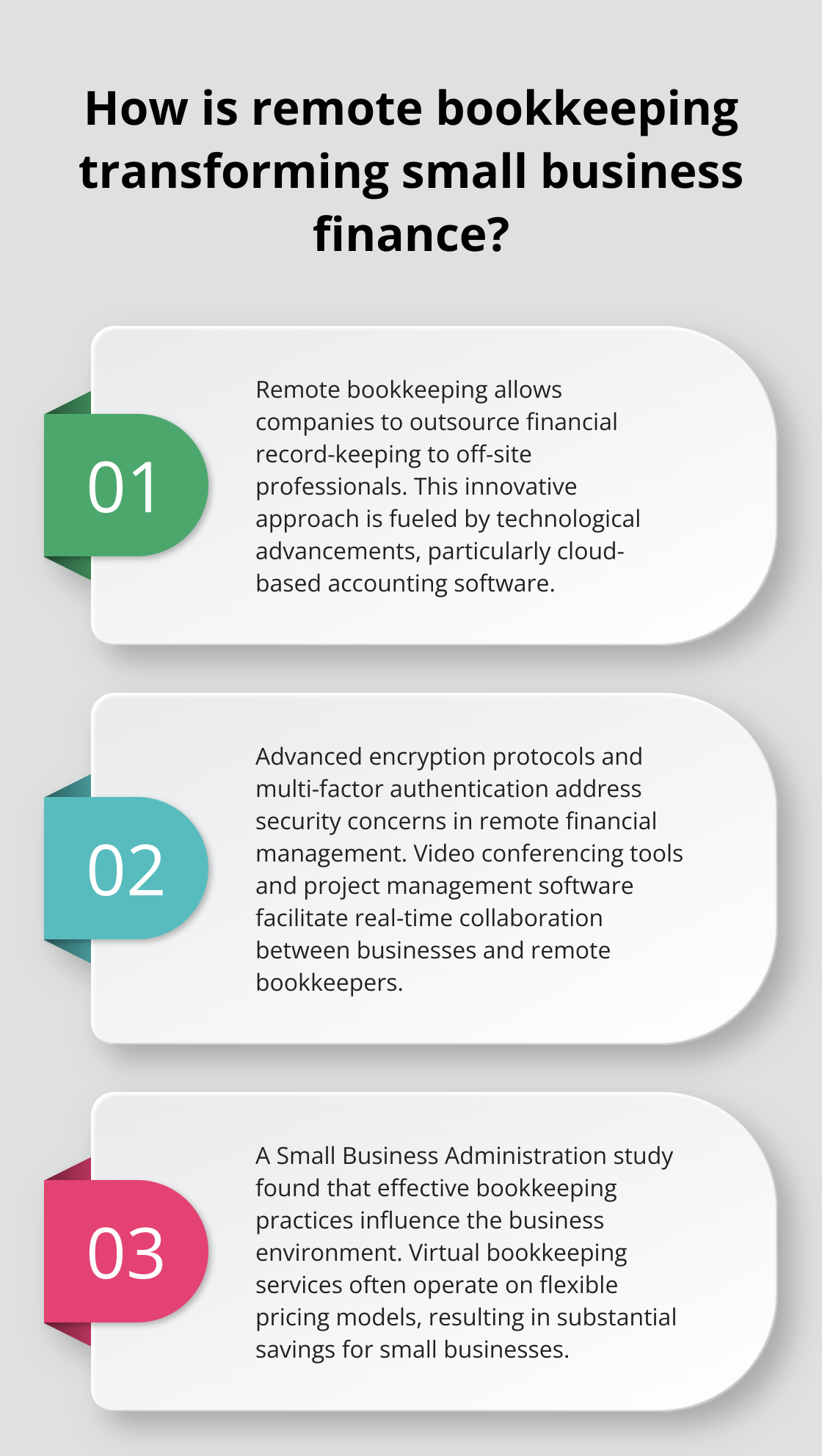

Remote bookkeeping revolutionizes financial management for small businesses. This innovative approach allows companies to outsource their financial record-keeping to off-site professionals who work from home offices or dedicated remote workspaces.

Technological advancements fuel the rapid adoption of remote bookkeeping. Cloud-based accounting software enables bookkeepers to access financial data securely from any location with internet connectivity. This shift eliminates the need for physical presence, creating new opportunities for small businesses to manage their finances efficiently.

Secure and Collaborative Technologies

Advanced encryption protocols and multi-factor authentication address many initial security concerns associated with remote financial management. Cloud-based accounting solutions help improve financial management, offering better security and 24/7 technical support.

Video conferencing tools and project management software bridge the communication gap between businesses and their remote bookkeepers. These technologies facilitate real-time collaboration, ensuring prompt financial decisions with full transparency.

Small Businesses Lead the Charge

The trend towards remote bookkeeping stands out among small businesses. A Small Business Administration study found that effective bookkeeping practices could influence the business environment by contributing to new practices for small business owners and changes in daily operations.

Cost-Effective Expertise

Many small business owners switch to remote bookkeeping due to cost considerations. Virtual bookkeeping services often operate on flexible pricing models, allowing businesses to pay only for needed services. This results in substantial savings compared to maintaining a full-time bookkeeper on staff.

Furthermore, remote bookkeeping expands access to a wider talent pool. Companies can now work with highly qualified professionals from across the country, rather than limiting themselves to local options. This expanded access often translates to higher quality service at competitive rates.

As technology continues to evolve and remote work becomes increasingly normalized, the trend towards remote bookkeeping will likely accelerate. This shift offers exciting possibilities for small businesses to streamline their financial operations and focus on core business activities. The next section will explore the specific advantages that remote bookkeeping brings to small businesses in more detail.

Why Remote Bookkeeping Makes Sense for Small Businesses

Remote bookkeeping offers significant advantages for small businesses, revolutionizing financial management practices. A study by QuickBooks found that over 60% of small businesses now use cloud-based accounting solutions, highlighting the growing trend towards remote financial services.

Substantial Cost Savings

Remote bookkeeping can handle your business’s money management and save you time, money and headaches. According to the Small Business Administration, companies can save up to 40% on bookkeeping expenses by switching to remote services. This cost-effectiveness stems from the elimination of full-time staff, office space, and equipment needs. Small businesses pay only for the services they use, often resulting in savings of thousands of dollars annually.

Access to Top-Tier Expertise

Remote bookkeeping services provide small businesses with access to a wider pool of talent. Instead of limiting themselves to local options, companies can work with highly qualified professionals from across the country. This expanded access often translates to higher quality service at competitive rates. For instance, a small business in a rural area can now collaborate with experienced bookkeepers from major financial hubs, gaining insights that were previously out of reach.

Unmatched Flexibility and Scalability

The flexibility of remote bookkeeping stands out. Small businesses can easily adjust their service levels based on seasonal fluctuations or growth patterns. During peak seasons, additional support can quickly come on board without the hassle of hiring and training new staff. This scalability ensures that financial management grows in tandem with the business, providing a level of adaptability that traditional in-house bookkeeping struggles to match.

Time Savings for Business Owners

Perhaps the most valuable benefit of remote bookkeeping is the time it saves business owners. A survey by the National Small Business Association found that 40% of small business owners spend over 80 hours per year on tax preparation alone. Remote bookkeeping services take over these time-consuming tasks, allowing entrepreneurs to focus on core business activities. This shift in time allocation can lead to increased productivity and potentially higher revenues.

Remote bookkeeping is not just a trend; it’s a strategic move for small businesses looking to optimize their financial operations. The combination of cost savings, expert knowledge, flexibility, and time efficiency makes it an attractive option for companies of all sizes. As we move forward, it’s important to address potential challenges and solutions in implementing remote bookkeeping services (which we’ll explore in the next section).

Navigating Challenges in Remote Bookkeeping

Ensuring Data Security

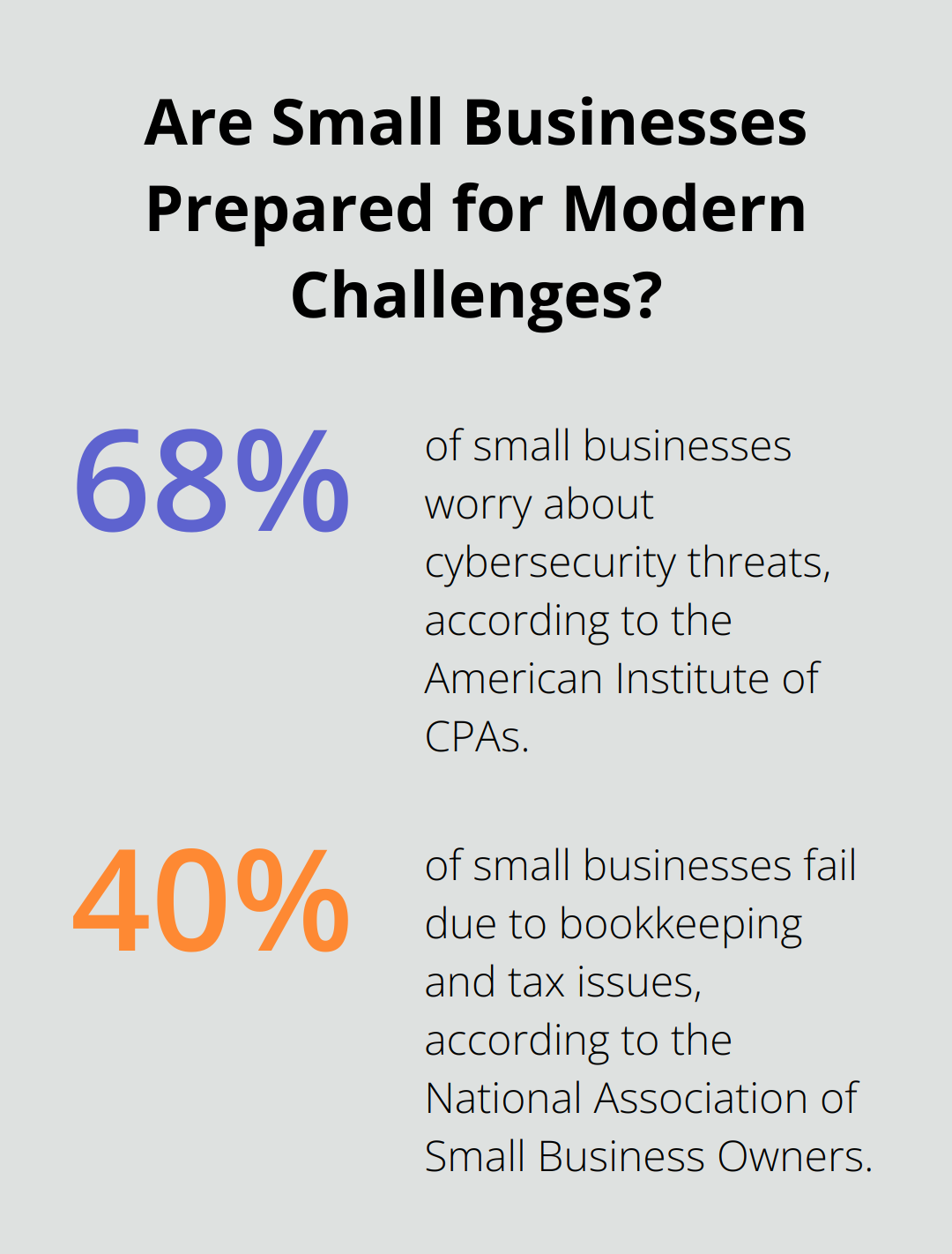

Data security remains a top concern for businesses considering remote bookkeeping. The American Institute of CPAs reports that 68% of small businesses worry about cybersecurity threats. To mitigate these risks, reputable remote bookkeeping services implement robust security measures. These include end-to-end encryption, multi-factor authentication, and regular security audits.

Small businesses should verify that their chosen provider adheres to industry-standard security protocols and maintains compliance with regulations like GDPR and CCPA. It’s essential to ask potential providers about their specific security measures and data protection policies.

Overcoming Communication Hurdles

Effective communication plays a vital role in successful remote bookkeeping. A study by the Project Management Institute found that ineffective communication contributes to project failure one-third of the time. To address this, businesses and their remote bookkeepers should establish clear communication channels and schedules.

Regular video conferences, instant messaging platforms, and shared project management tools can help maintain open lines of communication. Setting expectations for response times and update frequencies (e.g., weekly financial reports or monthly strategy meetings) ensures that both parties stay informed and aligned on financial matters.

Adapting to New Technologies

The transition to remote bookkeeping often requires adaptation to new software and processes. Top CFO challenges for 2023 include technology adoption and implementation. To ease this transition, businesses should seek providers that offer comprehensive onboarding and ongoing support.

Try to find remote bookkeeping services that provide training on their platforms and are willing to integrate with your existing systems when possible. This approach minimizes disruption and helps your team quickly adapt to new workflows.

Selecting the Right Service Provider

Choosing the right remote bookkeeping service is critical for success. Consider factors such as industry expertise, range of services, and client testimonials. The National Association of Small Business Owners suggests that 40% of small businesses fail due to bookkeeping and tax issues. Therefore, selecting a provider with a proven track record in your industry can significantly impact your business’s financial health.

When evaluating potential providers, ask about their experience with businesses similar to yours. Request case studies or references, and inquire about their approach to problem-solving. A provider that offers tailored solutions and proactive financial advice can become a valuable partner in your business growth.

Maintaining Financial Control

Some business owners worry about losing control over their finances when switching to remote bookkeeping. To address this concern, look for providers that offer real-time access to financial data and regular reporting. This transparency allows you to maintain oversight while benefiting from expert financial management.

Additionally, establish clear roles and responsibilities between your business and the remote bookkeeping service. This clarity (often formalized in a service agreement) helps prevent misunderstandings and ensures that all financial tasks are properly managed.

Final Thoughts

Remote bookkeeping has revolutionized financial management for small businesses. It offers cost-effectiveness, expertise, and flexibility that traditional in-house bookkeeping cannot match. Small businesses can now access top-tier financial professionals, enjoy unparalleled scalability, and save significant time for core business activities.

The future of remote bookkeeping for small businesses looks exceptionally promising. As technology advances and remote work normalizes, more small businesses will embrace this approach to financial management. The trend towards cloud-based solutions and the demand for flexible, cost-effective services indicate a long-term evolution in small business finance management.

At 7B Bookkeeping & Tax LLC, we provide secure, remote financial management solutions to help businesses thrive. Our team (including a Chartered Tax Professional and Enrolled Agent) offers comprehensive financial services tailored to small businesses’ unique needs. We stand ready to support your business in this evolving landscape of remote financial management.