Tax season can be stressful, but remote taxes are changing the game. At 7B Bookkeeping & Tax LLC, we’ve seen a surge in clients opting for this convenient approach.

Remote tax preparation offers flexibility and efficiency, allowing you to handle your taxes from the comfort of your home. But is it the right choice for you?

What Is Remote Tax Preparation?

The Digital Revolution in Tax Filing

Remote tax preparation has transformed the tax filing landscape. This process allows you to submit your tax documents electronically to a professional who prepares your return without face-to-face meetings. An AI-enabled digital tax workflow automates every step of the tax prep process, from obtaining client data, to preparing and reviewing returns.

How Remote Tax Preparation Works

The process typically begins with a secure online portal where you upload your tax documents (W-2 forms, 1099s, receipts, and other relevant financial information). Your tax preparer accesses these documents, prepares your return, and communicates with you via email, phone, or video chat for additional information or clarification.

Many firms utilize advanced tax software to ensure accuracy and compliance with the latest tax laws. Drake Software, for example, processes over 36 million tax returns annually, which demonstrates the scale and efficiency of remote tax preparation systems.

Securing Your Data in the Digital Age

Data security remains a top priority in remote tax preparation. Reputable services implement robust security measures, including:

- Multifactor authentication

- Data encryption

- Regular data backups

The FTC Safeguards Rule also helps maintain high security standards for tax professionals handling client data remotely.

Remote vs. Traditional: Key Differences

The primary distinction between remote and traditional tax preparation lies in the mode of interaction. Traditional methods involve in-person meetings and physical document exchanges, while remote preparation eliminates these needs. This shift not only saves time but also reduces overhead costs for tax preparation firms, potentially leading to savings for clients.

Another significant difference is accessibility. Remote tax preparation allows you to work with tax professionals regardless of geographical location. This expanded access means you can choose from a wider pool of experts, potentially finding someone who specializes in your specific tax situation.

As we move forward, let’s explore the numerous benefits that remote tax preparation offers to individuals and businesses alike.

Why Remote Tax Prep Is a Game-Changer

Unmatched Flexibility

Remote tax preparation revolutionizes the way we handle our taxes. It offers unparalleled flexibility, freeing you from the constraints of office hours and scheduled appointments. You can upload documents and communicate with your tax professional at your convenience. This flexibility proves invaluable for busy professionals, parents, or those with non-traditional work schedules.

Time and Cost Efficiency

The elimination of travel and in-person meetings translates to significant time savings. You no longer need to take time off work or arrange childcare to visit a tax office. Many remote tax services operate with lower overhead costs, potentially resulting in more competitive pricing for clients.

Access to Specialized Expertise

Remote tax preparation expands your options beyond geographical limitations. This broader access allows you to find an expert who specializes in your specific tax situation (whether you’re dealing with complex investments, multiple state returns, or international tax issues). For example, an expatriate living abroad can easily work with a U.S.-based tax expert who specializes in expat taxes, regardless of their current location.

Enhanced Security Measures

Contrary to common misconceptions, remote tax preparation often provides enhanced security compared to traditional methods. Digital systems employ advanced encryption, secure portals, and multi-factor authentication to protect your sensitive financial information. The FTC Safeguards Rule has established high security standards for remote tax preparation services. This level of security often surpasses the protection offered by physical document storage and transportation.

Streamlined Communication

Remote tax preparation facilitates clear and efficient communication. Many platforms offer real-time chat features, secure messaging systems, and video conferencing options. These tools enable quick clarifications, easy document sharing, and seamless collaboration between you and your tax professional. This streamlined communication often results in faster turnaround times and a more thorough understanding of your tax situation.

As we explore the potential drawbacks and considerations of remote tax preparation, it’s important to weigh these benefits against your personal preferences and specific tax needs.

Navigating the Challenges of Remote Tax Prep

Remote tax preparation offers numerous benefits, but it also presents challenges. Understanding these potential hurdles will help you decide if this approach aligns with your needs and preferences.

The Personal Touch Dilemma

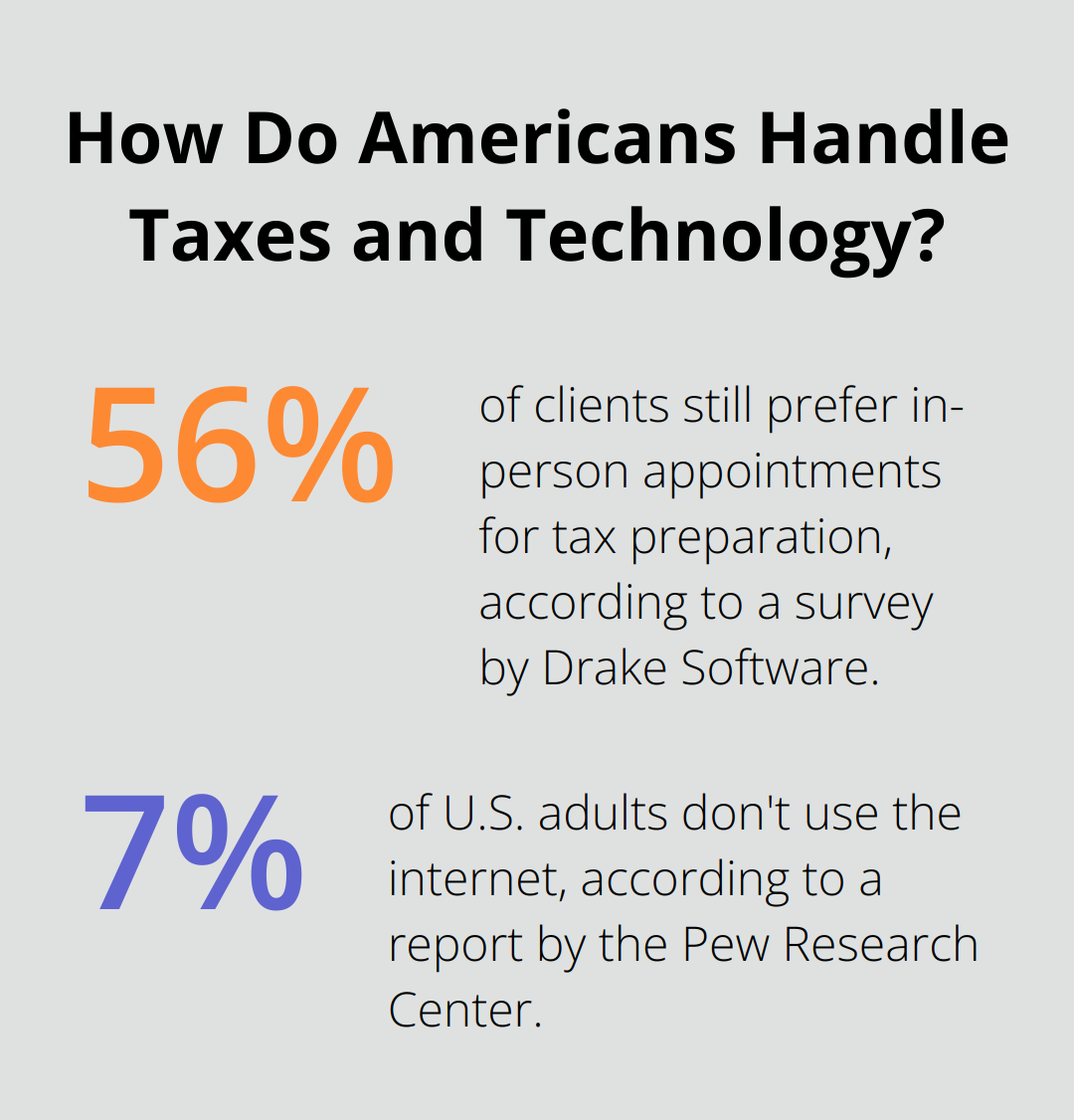

One significant drawback of remote tax preparation is the lack of face-to-face interaction. For some, the absence of in-person meetings feels impersonal or less reassuring. A survey by Drake Software found that 56% of clients still prefer in-person appointments, although they’re open to virtual options. This preference highlights the value many place on direct, personal interactions when discussing sensitive financial matters.

To address this issue, many remote tax preparation services now offer video conferencing options. These allow for a more personal connection while maintaining the convenience of remote services. If you consider remote tax prep, ask about video consultation options to bridge the gap between convenience and personal interaction.

Tech Savvy Required

Remote tax preparation relies heavily on technology, which can be a barrier for some. You need a reliable internet connection, a device capable of uploading documents, and the ability to navigate online portals and communication tools. A report by the Pew Research Center states that about 7% of U.S. adults don’t use the internet, which could make remote tax prep challenging for this group.

If you’re not tech-savvy, look for services that offer user-friendly interfaces and robust customer support. Many providers offer guidance on using their digital platforms, making the transition to remote tax prep smoother.

Complex Situations Demand Expertise

While remote tax preparation can handle most tax situations, extremely complex cases might benefit from in-person consultations. For instance, if you deal with multi-state returns, international income, or intricate business structures, you might need more detailed discussions that are easier to conduct face-to-face.

However, this doesn’t mean remote tax prep can’t handle complexity. Many remote tax professionals are highly qualified to manage intricate tax situations. The key is to find a service with expertise in your specific area of need. For complex tax situations, some firms offer professional services that allow you to file your taxes from the comfort of your home using specialized apps or browsers.

Choosing a Trustworthy Provider

The rise of remote tax preparation has also seen an increase in less reputable services. It’s important to choose a provider with a solid reputation and proper credentials. The IRS reports that in 2020, they identified $2.3 billion in tax fraud, highlighting the importance of working with trusted professionals.

When selecting a remote tax preparation service, verify their credentials and look for reviews from past clients. Check if they’re members of professional organizations like the National Association of Tax Professionals or the American Institute of Certified Public Accountants. These affiliations often indicate a commitment to professional standards and ongoing education.

Final Thoughts

Remote taxes offer convenience, efficiency, and accessibility, transforming how we handle our financial obligations. This approach brings flexibility, potential cost savings, and access to specialized expertise. However, it’s important to consider potential drawbacks such as the lack of face-to-face interaction and technological challenges.

At 7B Bookkeeping & Tax LLC, we understand the nuances of remote taxes and provide secure, efficient, and personalized services. Our team includes a Chartered Tax Professional and Enrolled Agent to ensure expert handling of your tax needs. We also offer comprehensive bookkeeping services, financial consulting, and QuickBooks setup and training.

For expert tax preparation or comprehensive financial services, 7B Bookkeeping & Tax LLC is ready to assist you. We combine the benefits of remote services with personalized attention to maximize your savings and minimize liabilities. Our commitment to top-notch remote tax services remains steadfast as the landscape of tax preparation continues to evolve.