Are you leaving money on the table when it comes to your taxes? Many business owners overlook valuable deductions that could significantly reduce their tax burden.

At 7B Bookkeeping & Tax LLC, we’ve seen countless clients miss out on potential savings simply because they weren’t aware of all the business deductions available to them.

This guide will walk you through essential tax write-offs and strategies to help you keep more of your hard-earned money in your pocket.

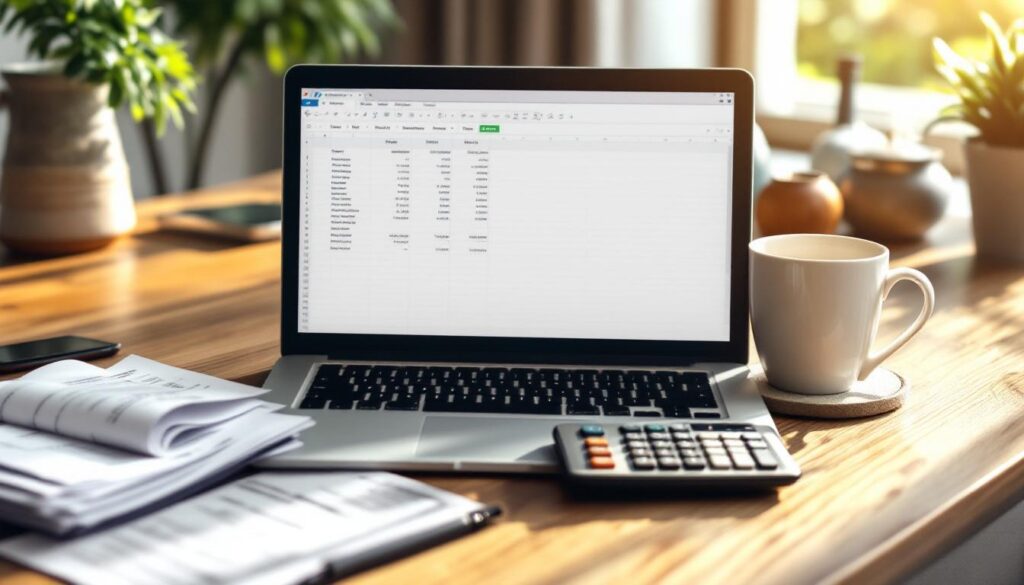

Hidden Tax Deductions for Your Business

Many business owners miss valuable tax deductions that could lower their tax burden. Let’s explore some often-overlooked deductions that could save you money.

Home Office Expenses

If you use part of your home exclusively for business, you might qualify for the home office deduction. The IRS allows you to deduct $5 per square foot (up to 300 square feet) using the simplified method. You can also calculate actual expenses based on the percentage of your home used for business. This includes a portion of your mortgage interest, property taxes, utilities, and maintenance costs.

Vehicle and Mileage Costs

Business-related travel can lead to substantial deductions. For 2024, the standard mileage rate is 70 cents per mile for business use. This covers gas, oil, repairs, and vehicle depreciation. Keep a detailed log of your business trips, including dates, destinations, and purposes. You can also deduct actual vehicle expenses instead, but this requires more extensive record-keeping.

Professional Development and Education

Investing in your skills can reduce your tax bill. Courses, seminars, and workshops directly related to your business are fully deductible. This includes online courses, conference fees, and associated travel expenses. Even books and subscriptions to professional publications can be written off. These expenses must be ordinary and necessary for your business to qualify.

Advertising and Marketing Expenses

Every dollar you spend to promote your business can be deducted. This includes traditional advertising, business cards, and website costs. Social media marketing expenses (including paid ads on platforms like Facebook or Google) are also fully deductible. Don’t overlook sponsorships or charitable donations that promote your business – you can often write these off as well.

Technology and Software Costs

In today’s digital age, technology plays a crucial role in business operations. You can deduct expenses for computers, smartphones, and tablets used for work. Software subscriptions (such as accounting programs or design tools) are also tax-deductible. Cloud storage services and cybersecurity measures fall under this category too.

These hidden deductions can significantly impact your tax savings. As we move forward, let’s examine how different business structures can maximize their deductions.

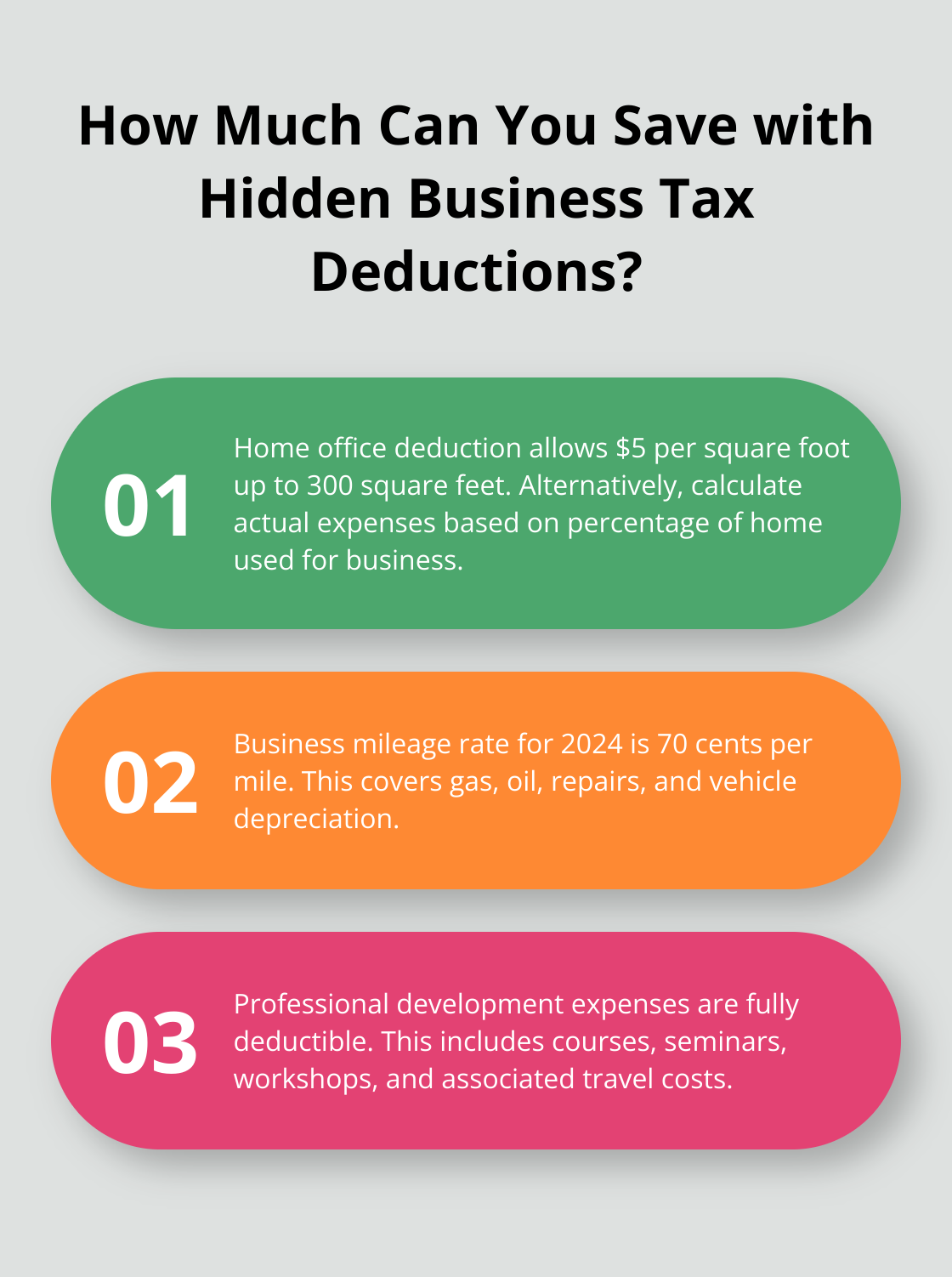

How Business Structures Impact Tax Deductions

Different business structures offer unique tax advantages and deduction opportunities. Your business structure impacts your tax situation significantly, affecting how you can maximize savings.

Sole Proprietorships: Simple and Flexible

Sole proprietors file taxes in a straightforward manner. They report business income and expenses on Schedule C of their personal tax returns. This structure allows easy claiming of deductions such as home office expenses, health insurance premiums, and self-employment retirement contributions. However, sole proprietors pay higher self-employment taxes (both the employer and employee portions of Social Security and Medicare taxes).

Partnerships: Shared Benefits and Responsibilities

Partnerships use pass-through taxation. Profits and losses flow through to the partners’ individual tax returns. Each partner can deduct their share of business expenses, including unreimbursed partnership expenses. Partnerships can also deduct guaranteed payments to partners (similar to salaries). Partners must maintain detailed records of their contributions and expenses to maximize deductions.

S Corporations: Salary and Distribution Balance

S corporations provide potential tax savings through income splitting between salary and distributions. Owners must pay themselves a reasonable salary, subject to payroll taxes. Additional profits can be taken as distributions, which aren’t subject to self-employment taxes. This structure allows deductions on health insurance premiums and retirement contributions for owner-employees. S corporations must carefully balance salary and distributions to avoid IRS scrutiny.

C Corporations: Broad Corporate-Level Deductions

C corporations face double taxation. However, they offer the broadest range of deductible expenses. C corporations can deduct salaries, bonuses, and benefits paid to employees (including owner-employees) as business expenses. They have more flexibility in deducting fringe benefits like health insurance and retirement plans. Additionally, C corporations can carry forward net operating losses indefinitely, providing tax benefits in future profitable years.

Choosing the right business structure involves complex decisions that significantly impact your tax situation. Expert guidance can help you navigate these choices to optimize your tax strategies. A professional can explain the pros and cons of each structure, ensuring you make the most of available deductions while staying compliant with IRS regulations.

Now that we’ve explored how business structures affect deductions, let’s examine effective strategies to track and organize these deductions for maximum benefit. Filing your taxes early can help you better manage your deductions and ensure a smoother tax season.

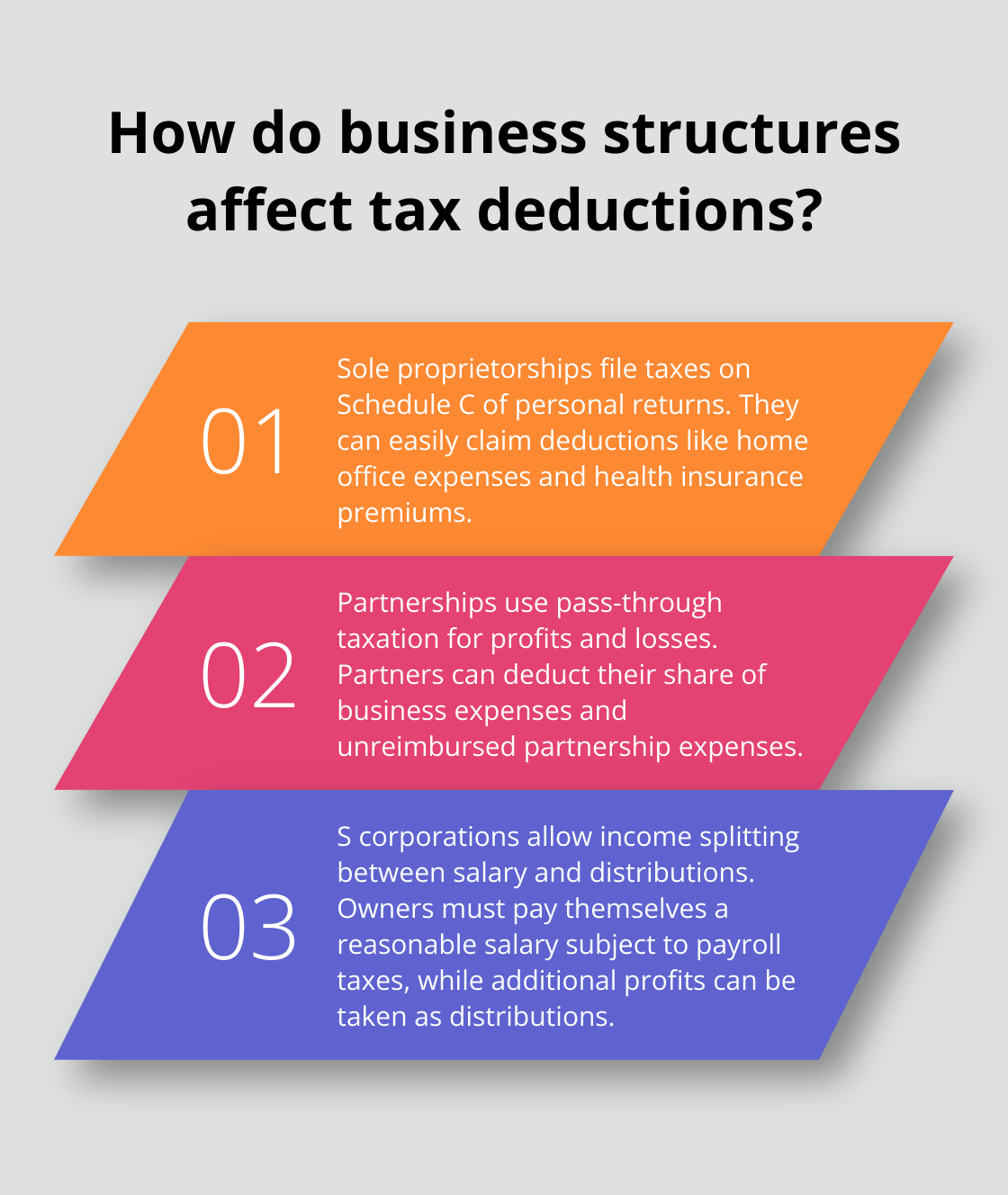

How to Track Deductions Effectively

Tracking and organizing your business deductions plays a key role in maximizing tax savings and ensuring compliance with IRS regulations. Effective strategies simplify the process and help you capture every eligible expense. Here are practical approaches to streamline your deduction tracking:

Use Cloud-Based Accounting Software

Modern accounting software can transform how you track expenses. Cloud accounting offers key benefits for small businesses, such as cost savings, real-time access to data, and scalability. These platforms allow you to categorize transactions in real-time, often automatically based on rules you set. You can tag all purchases from office supply stores as deductible business expenses. Many of these tools also integrate with your bank accounts and credit cards, pulling in transaction data automatically.

Adopt a Digital Receipt System

Digital receipt management systems allow you to snap photos of receipts with your smartphone and automatically extract relevant information. These tools can sync with your accounting software, creating a seamless expense tracking workflow.

Keep Personal and Business Finances Separate

Maintaining separate bank accounts and credit cards for your business is not just a best practice-it’s essential for accurate expense tracking. This separation makes it easier to identify business expenses and reduces the risk of overlooking deductions.

Work with a Tax Professional Regularly

While DIY tax preparation software has its place, nothing beats the personalized advice of a tax professional who understands your business. Professional tax advice can lead to significant tax savings and reduced financial stress. Try to schedule quarterly check-ins with your tax advisor. These meetings allow you to review your financial position, discuss potential deductions, and adjust your tax strategy as needed.

The National Society of Accountants reports that taxpayers who work with a professional tax preparer save an average of $5,600 on their federal tax returns compared to those who self-prepare. This savings often outweighs the cost of professional services (especially when considering the peace of mind and time saved).

Final Thoughts

Business deductions can significantly reduce your tax burden and increase your financial flexibility. Different business structures offer unique advantages, so you must understand how your entity type impacts deductions. Proper documentation forms the foundation of successful tax planning, and implementing robust tracking systems will streamline the process.

The complexities of business deductions often require professional expertise. Working with a tax professional can lead to substantial savings and peace of mind. 7B Bookkeeping & Tax LLC specializes in helping businesses navigate the intricacies of tax deductions and offers comprehensive financial services.

Our team of experts provides secure, remote tax preparation, reliable IRS representation, and flat-rate bookkeeping services. We strive to help you maximize savings, minimize liabilities, and focus on growing your business. Regular check-ins with a tax professional will help you adjust your strategy as your business evolves and tax laws change.