Tax debt can be overwhelming, causing sleepless nights and financial stress. At 7B Bookkeeping & Tax LLC, we’ve seen firsthand how unpaid taxes can impact individuals and businesses.

The good news is that tax debt resolution options exist. This post will guide you through various relief programs and strategies to help you regain control of your finances and find peace of mind.

Why Tax Debt Occurs

Tax debt doesn’t materialize out of thin air. It often results from specific financial circumstances or oversights. Let’s explore the common causes and consequences of tax debt.

Unexpected Life Events

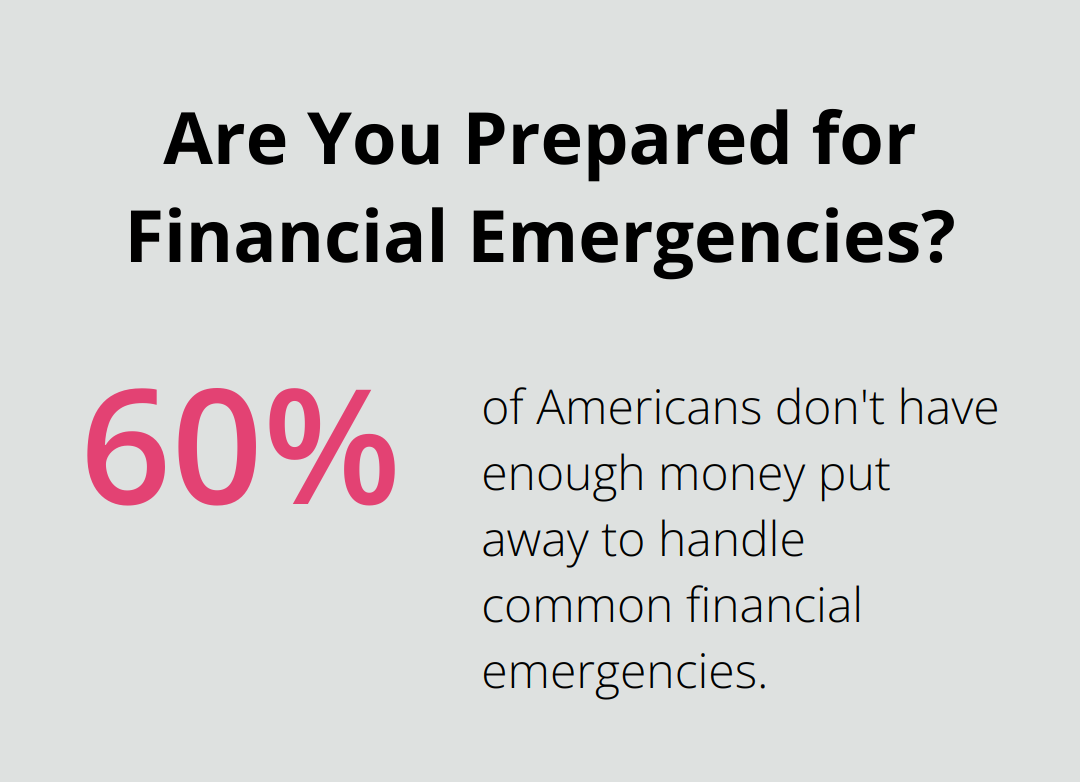

Life can throw curveballs. A sudden job loss, medical emergency, or divorce can deplete savings and make tax payments difficult. Nearly 60% of Americans don’t have enough money put away to handle common financial emergencies, highlighting the vulnerability many face to financial shocks that could lead to tax debt.

Miscalculation of Tax Obligations

Tax debt sometimes stems from simple errors. Self-employed individuals or small business owners might underestimate their quarterly tax payments. The IRS reports that about 5 million taxpayers face penalties each year for underpayment of estimated taxes.

Problem Avoidance

Procrastination can transform a manageable tax bill into serious debt. The IRS charges interest and penalties on unpaid taxes, which can quickly snowball. For example, the failure-to-pay penalty is 0.5% of the unpaid taxes for each month (up to 25% of the total tax due).

Consequences of Unpaid Taxes

Ignoring tax debt can lead to severe repercussions. The IRS has the authority to garnish wages, place liens on property, and even seize assets.

The Importance of Prompt Action

Addressing tax debt promptly is essential. The longer you wait, the fewer options you have. For instance, to qualify for an Offer in Compromise, you must be current on all tax filings and not be in an open bankruptcy proceeding.

Understanding the causes and consequences of tax debt is the first step towards resolution. In the next section, we’ll explore the various IRS tax relief programs available to help you tackle your tax debt head-on.

IRS Tax Relief Options

The IRS provides several programs to help taxpayers manage their tax debt. These options offer relief and a path towards financial stability. Let’s explore the most common tax relief programs and their potential benefits.

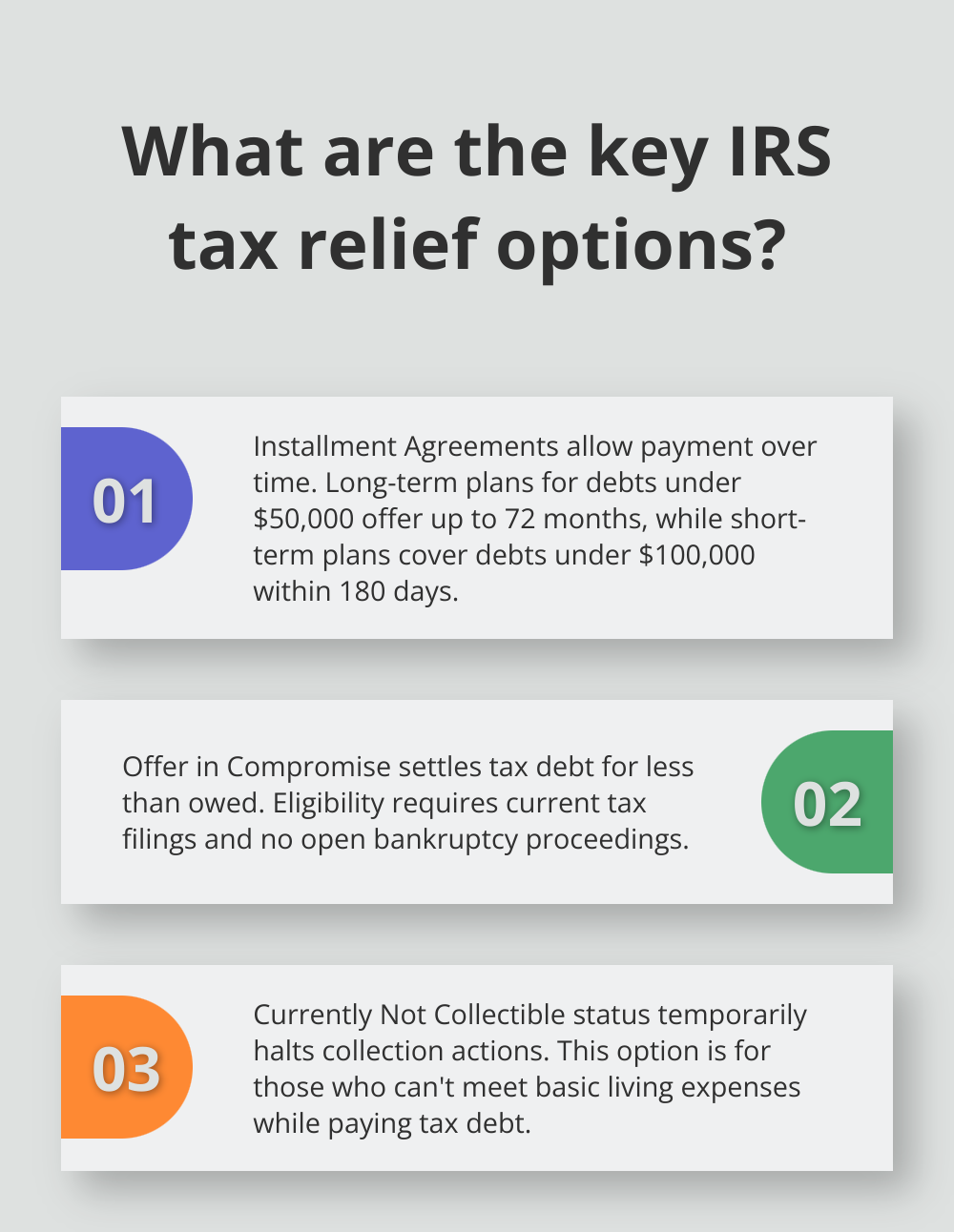

Installment Agreements

Installment agreements allow you to pay your tax debt over time. The IRS offers both short-term and long-term payment plans:

- Long-term payment plans: For debts under $50,000, you can apply online for a plan that gives you up to 72 months to pay. The setup fee ranges from $31 to $225 (depending on your income and application method).

- Short-term payment plans: Available for those who owe less than $100,000 in combined tax, penalties, and interest. These plans allow payment within 180 days and have no setup fee.

Offer in Compromise

An Offer in Compromise (OIC) allows you to settle your tax debt for less than the full amount owed. This option suits those who can’t pay their full tax liability or would face financial hardship by doing so. Historically, the IRS has a lower OIC acceptance rate for business taxpayers than individual taxpayers.

To qualify, you must:

- Be current on all tax filings

- Not be in an open bankruptcy proceeding

The IRS evaluates your ability to pay, income, expenses, and asset equity when considering your offer.

Currently Not Collectible Status

If paying your tax debt would prevent you from meeting basic living expenses, you might qualify for Currently Not Collectible (CNC) status. This status temporarily halts collection actions, giving you time to improve your financial situation.

It’s important to note that interest and penalties continue to accrue while in CNC status. The IRS will periodically review your financial situation to determine if you can begin making payments.

Penalty Abatement

The IRS may remove or reduce penalties if you have a reasonable cause for not complying with tax laws. Common reasons include:

- Natural disasters

- Death or serious illness in the immediate family

- Inability to obtain necessary records

First-time penalty abatement is also available for those who have a clean compliance history for the past three years.

Navigating these IRS programs can be complex. Professional assistance can significantly increase your chances of approval and ensure you choose the best option for your specific situation. The next section will explore strategies to effectively manage your tax debt and work towards resolution.

How to Tackle Your Tax Debt

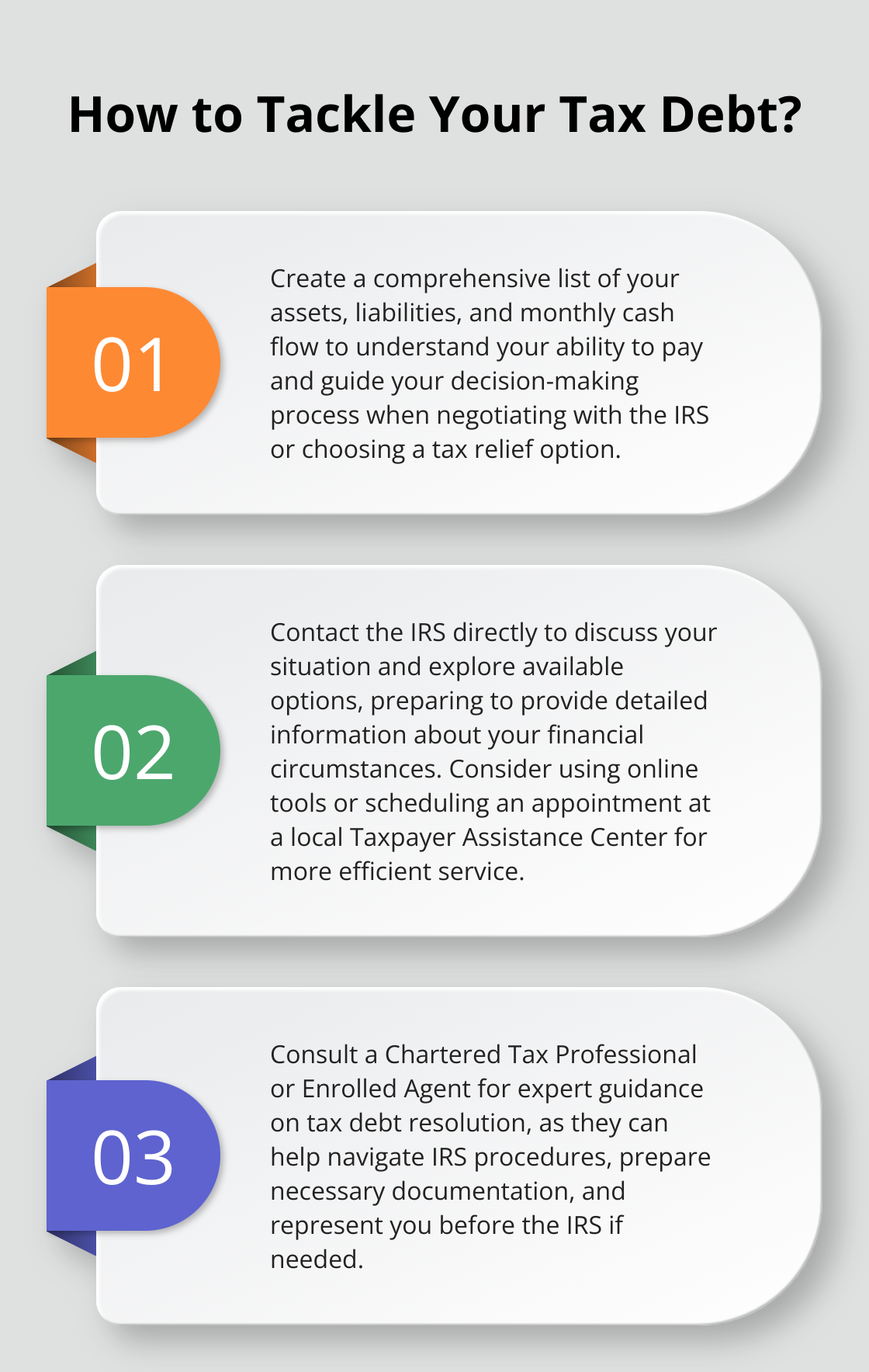

Conduct a Financial Self-Audit

Start with a thorough assessment of your financial situation. Collect all relevant documents, including tax returns, income statements, and expense records. Create a comprehensive list of your assets, liabilities, and monthly cash flow. This financial snapshot will help you understand your ability to pay and guide your decision-making process.

A survey by the National Foundation for Credit Counseling found that only 39% of Americans have a good idea of their financial situation. Don’t become part of this statistic. A clear understanding of your finances is essential when negotiating with the IRS or choosing a tax relief option.

Open Lines of Communication with the IRS

Many taxpayers avoid contacting the IRS out of fear or anxiety. However, proactive communication can work in your favor. The IRS often shows more willingness to work with taxpayers who voluntarily come forward than those who ignore their tax obligations.

Contact the IRS to discuss your situation and explore available options. Prepare to provide detailed information about your financial circumstances. The IRS receives 282 million calls annually (so patience is key). Consider using the IRS’s online tools or schedule an appointment at a local Taxpayer Assistance Center for more efficient service.

Seek Professional Guidance

Tax debt navigation can be complex, and mistakes can be costly. A tax professional can provide invaluable assistance in assessing your situation, understanding your options, and developing a strategy tailored to your needs.

A Chartered Tax Professional or Enrolled Agent can offer expert guidance on tax debt resolution. They can help you navigate IRS procedures, prepare necessary documentation, and represent you before the IRS if needed.

Explore All Payment Options

While the IRS offers several relief programs, it’s important to explore all available payment options. This might include:

- Use of savings or sale of non-essential assets

- Borrowing from family or friends

- Taking out a personal loan or home equity line of credit

- Using a credit card (though be cautious of high interest rates)

Each option has pros and cons, and the best choice depends on your individual circumstances. For instance, while using retirement funds might seem tempting, it could lead to additional taxes and penalties, potentially worsening your situation.

Addressing tax debt requires patience and persistence. Take these strategic steps and seek professional help when needed to work towards resolving your tax debt and achieving financial stability.

Final Thoughts

Tax debt resolution requires immediate action to prevent further complications. The IRS provides various relief options, including installment agreements and Offer in Compromise programs, tailored to different financial situations. Professional assistance proves invaluable when navigating the complexities of tax debt resolution.

7B Bookkeeping & Tax LLC specializes in helping individuals and businesses tackle their tax debt challenges. Our team includes a Chartered Tax Professional and Enrolled Agent who can provide expert guidance on the best tax relief options for your specific situation. We offer comprehensive financial services, including tax preparation, bookkeeping, and financial consulting.

Don’t let tax debt control your financial future. Take the first step towards resolution today by reaching out to 7B Bookkeeping & Tax LLC. We will develop a tailored plan to address your tax debt, restore your financial health, and provide you with peace of mind.